You gotta love it when a prediction comes true. A little over a month ago I predicted a pivot out of Swipely and Blippy because no one is going to their sites and no one want so publicly share credit card transactions. Well a couple of days ago Mashable announced that Swipely wants to be an auto-rewards network for merchants. Welcome to the club Swipely, you’ve got some nice competition from Kleiner Perkins funded Offermatic, who after launch has a similarly nascent traffic rank. Let’s be honest here, both public sharing and rewards networks are tough spaces to play in. Nevertheless, I applaud you for pivoting (man I hate that word) and changing your strategy when you realized it needed to shift. That’s the sign of a good entrepreneur. Good luck with the new vision!

From the category archives:

Predictions

What’s Surprising is that Everyone is Acting Surprised

MG Siegler over at TechCrunch just penned a great post about the ongoing war between Twitter and Bill Gross’s UberMedia and Twitter. He summed up the situation perfectly in my mind. I could not have said it better myself:

“WHAT’S SURPRISING ABOUT ANY OF THIS IS THAT PEOPLE ARE ACTING SURPRISED” – MG Siegler

I’ve been saying this for a long time now…why would anyone in their right mind think that Twitter would allow another company to build a multi-million (or billion) dollar business on the back of their own ecosystem?

It would be like a Facebook / Zynga repeat all over again only in that Facebook needed Zynga to monetize early.

Twitter does NOT need local Twitter publishing clients anymore now that they have their own, decent client. Not only do they not need them but they certainly don’t need to let them get rich by posting affiliate links and finding other monetization streams that they don’t share heavily with Twitter itself.

Yes, it would have been nice if Twitter had given fair notice to Ubermedia, but oh well. When you’re in a real life fight, punching below the belt and eye gouging are totally fair game.

[Stock Photo Credit: Fotolia.com]

{ 2 comments }

Back of the Envelope: How to Estimate the Annual Revenues of Any Private Company

Have you ever wondered how much money a particular company makes? Perhaps you just wanted to know their annual sales? The only problem was, the company was small (i.e. not publicly traded) so there’s no public financial information available on them. So how do you calculate their revenues?

I created a simple, back of the envelope (i.e. quick and dirty), mathematical calculation that accurately estimates the revenue of pretty much any public / private company, large or small. It’s certainly possible that I’m not the first to come up with this calc, but for now, I’ll take the credit for it. Here’s how it works:

ANNUAL REVENUE = NUMBER OF EMPLOYEES X $100,000

That’s it! It’s that simple. Now let me briefly explain the logic behind this one. The average American makes a little over $40,000 per year. The costs of an employee to an employer is about 1.25x their base salary. The additional 25% comes from payroll taxes, health insurance, worker’s comp insurance, office space for them to sit in, etc. Therefore, the employer must bring in $50,000 ($40,000 x 1.25) for every employee in the company. Because most companies have a gross profit of 50% or so, this means that in order to stay in business, the average company must have $100,000 in revenue for every employee in their company (($100k x 50%) – $50k) = $0 or Break Even). The companies with more than $100k in sales per employee are more profitable (e.g. GOOG) than those that don’t (e.g. pretty much every startup company on the planet that takes VC / Angel money).

We so often hear about how well a company is doing based on their press releases, speaking engagements by their founders, etc.; however, no one ever wants to tell you exactly how much money their company makes. The next time you want to know how much revenue someone’s company is doing, don’t just ask them point blank. Instead, simply ask them how many employees they have. Every CEO will tell you how many employees they have. If they won’t tell you, just ask one of their employees how many people work in the company. Once you have that number, simply multiply it by $100k, and you now have a quick and dirty (and in my experience, highly accurate) estimate of their annual sales.

A word of caution on startups…If the company is a startup, you can pretty much rest assured that they are doing way less than $100k per employee. For now, assuming the company has a business model where they actually sell something), take their number of employees and multiply by $50k instead of $100k to arrive at the annual revenue estimate. In a later post, I’ll explain how you can more accurately nail down the exact revenues of a cash burning startup. In addition, I plan to explain how to accurately estimate a startup’s market cap (i.e. how much the company is worth) in a calculation just as simple as the one you’ve read about here today.

UPDATE: I’ve been reading in the comments about how the calc needs to be adjusted upwards / downwards depending on the industry (Duh! It’s a “back of the envelope” ESTIMATE, hence the title of this post!). Therefore, I’ve come up with a simple adjustment such that it works for nearly any industry. The revised formula is as follows:

ANNUAL REVENUE = NUMBER OF EMPLOYEES X AVERAGE SALARY OF AN EMPLOYEE IN YOUR INDUSTRY X 2.5

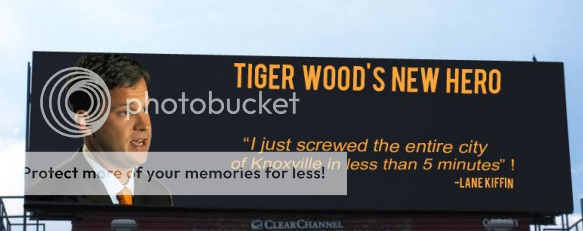

The Curse of Lane Kiffin

DISCLAIMER: If you attended USC, please don’t be offended by this post. It’s really not your fault.

Before we head into the 2010 college football season, I just have to get a prediction out of the way, one that’s been on my mind for a while now. I’m hereby predicting a 20 year curse on the University of Southern California brought on by their hiring of Lane Kiffin as head coach. During the next 20 years, USC WILL NOT WIN ANOTHER NATIONAL TITLE. I’ll even go on to say that during this 20 year period THEY WILL HAVE A LOSING BOWL GAME RECORD, regardless of how long Lane Kiffin sticks around.

For a little backstory, Lane Kiffin coached the Oakland Raiders for a little over one season with an overall record of 5-15 as an NFL coach. He was fired from the Raiders and even called a “flat our liar” by Raiders owner Al Davis. He went on to sign a 6 year deal to coach the University of Tennessee Volunteers, taking over for the legendary Phillip Fulmer (the Vols were the 1998 National Champ under Fulmer). Before UT’s season even started, Lane was talking trash about SEC powerhouse Florida and their well respected coach Urban Meyer. In 2009, Lane coached the Vols to a mediocre 7 -6 season. To show his pride and dedication to the University, Lane even named his son “Knox“, after UT’s home city, Knoxville.

At the conclusion of the 2009 season, 5 years before the expiration of his contract, Lane turned his back on the city for which he named his son after and resigned from Tennessee to take the head coaching job at USC, which was vacant after Pete Caroll took a position with the Seattle Seahawks. This is the move (dissing Tennessee for USC) that I truly believe will bring about the 20 year curse of Lane Kiffin, during which time the USC Trojans will not win another national championship and have a losing bowl game record.

Soon after Kiffin arrived at USC, his curse went into full effect as the Trojans were banned from postseason play for 2 years due to recruiting violations from the Reggie Bush / Pete Carroll days. More recently, and this certainly won’t be the last controversy he causes, Kiffin went behind the back of Titans coach Jeff Fisher, one of the most respected head coaches in the NFL, to illegally recruit an offensive coordinator and he’s now being sued for it. USC fans, good luck with your new coach. I predict that it’s going to be a tough couple of decades under the curse of Lane Kiffin.

Related articles:

- Tennessee Titans to Sue Lane Kiffin (bleacherreport.com)

- Lane Kiffin: The Most Dangerous Man in Sports (bleacherreport.com)

- Lane Kiffin Tackles the NCAA Sanctions at USC (bleacherreport.com)

Is the honeymoon over for @blippy? @pud, perhaps it’s time to buy some new users?

Blippy.com, the darling of Silicon Valley, having raised a Series B round of $11.2M just 4 months ago, seems to be going through a rough patch these days. US Traffic on the site (as measured by compete.com) has waned significantly over the past 3 months to what I would call “tiny little, barely funded startup levels”. They’ve been live about 6 months and Blippy’s traffic to date peaked in April 2010 right around the time they were caught up in a privacy leak scandal in which the full credit card number of users were found in Google’s search index cache.

So what will Blippy do to regain it’s momentum? I’m predicting a massive display ad campaign / press circuit / viral campaign tour in the coming months. Regardless, the site has certainly not seemed to take off like a rocket. Perhaps people really don’t want to share their credit card transactions publicly and that a real time stream of purchases is not going to win the social shopping space?

UPDATE: This post was drafted 8/3/2010 around 2pm PST. At 5pm the same day, Blippy made a nice PR move and released a funny 404 page that got great viral coverage. These guys certainly have a good sense of humor. I guess from now on I’ll have to publish posts as they are written because even a one day delay can spoil a scoop.

Related articles:

- Blippy Has Pretty Much The Best 404 Page Ever. What Does It Mean? (techcrunch.com)

- Blippy Issues, Resolutions, Plan (blippy.com)

- The Saga of Blippy, or Why There Is No Cure For Stupid (infosecurity.us)